How to fill IT Return Online – Filling Income Tax Returns is something that frightens most of the Indian taxpayers. The reason behind its utter complexity. Therefore, the maximum of the taxpayers approaches to Chartered Accountant. Sometimes approaching to CA takes excessive time. Consequentl,y Taxpayers rated as defaulter bythe IT Department.

But I think the Complexity of IT Return is just user perceptions and it should be quashed. Time and again Income Tax Department has made provision to ease facility of IT Return. So, Income Tax payers have to follow guidelines and be ready to fill Return within a set time. In this article, I am trying to discuss about online IT Return Filling. As an example I take instance of Salary earned Individuals

Surely you have to procure the Form 16, which is provided by your employer. Form 16 has the statement of your taxable salary and allowed deduction as well. All salary earned employees have to meet HR Department for demanding of respective Form 16. It requires to be done up to 31st July in the wake of gaining Tax refund as per applicable Tax Slab. As you know well if your earning is under 05 Lakhs then there is no any need to fill IT Return. Now question is that who earns more than 05 lakhs how can they fill their IT Return?

Point-wise details may say every thing about IT Return filling online:

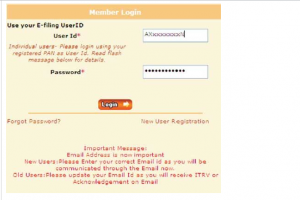

- Log on to Income Tax Department website

- Now making Login after own accounts creation

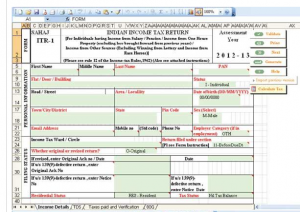

- Choose e-filing AY 2012-13 and select appropriate Income Tax Return (ITR). Download ITR-1’s and open downloaded Return Preparation software.

- Calculate Tax Payable by clicking ‘Calculate Tax’ and enter details of Challan and confirmed it by clicking ‘Validate’ tab.

- Now, to go Submit Return and upload XML file and relevant form

- Then after information about digital signature will be asked and after then message of Successful e-filling will be flashed on screen.

- Take Print out of ITR-V and put own signature and send the same to the Income Tax Department within 04 months of uploading IT Return.

income tax

says:Mr. Kaushal Singh, your article is very informative and easy to follow. What will happen if I have missed the deadline? Can I still go to income tax website for efiling and file my returns? Will I have to pay penalty – how much is the amount? I do not understand the meaning of digital signature, do I have to sign the print out and upload it. your help in this matter will be much appreciated.