SBI Online Banking has held n a rapid involvement of the customers in the past few years. Be it a transactional or non-transactional task, internet banking has made every work of the customer super easy. Transactional tasks include fund transfer, bill payments, etc. Now, while considering non transactional tasks of a customer means viewing account balances, recent transactions, downloading bank statements, account summary, ordering cheque books, etc. But you should have a clear idea that how to carry out these works online.

Recommended:

How to activate Internet Banking in SBI

How to Pay Money to SBI Account of Others Using NetBanking

SBI ATM Card Lost – How to Register Complaint, Get New Card

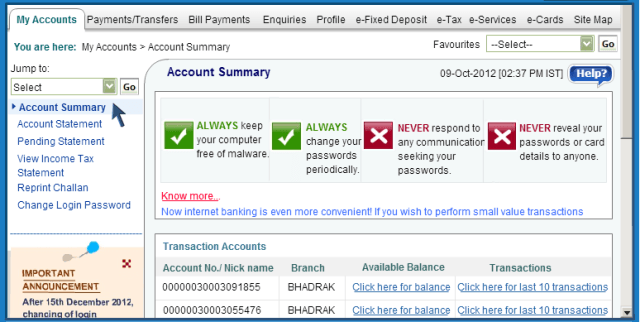

How to get Account Summary through SBI Online Banking

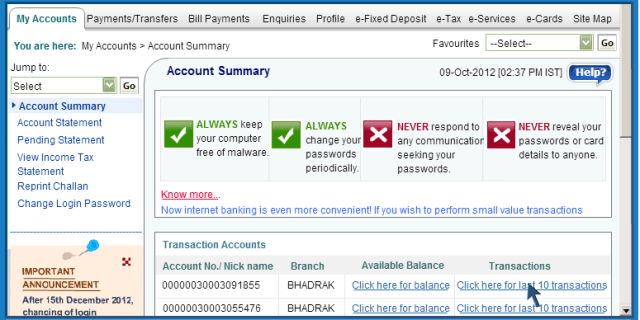

- Login to your account.

- Click on the “Account Summary” option on the left side of the page.

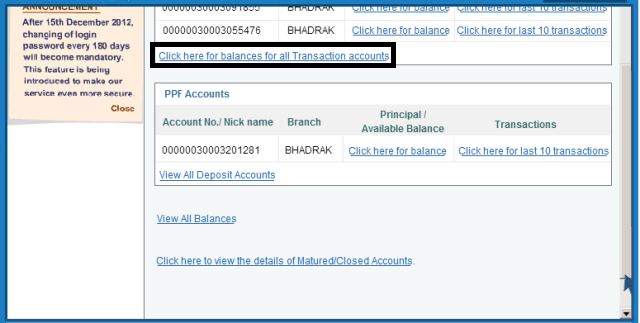

- The page manifests different account categories like Transaction Accounts (Current, OD and Savings) deposit, loan and PPF accounts.

- Each group exhibit accounts information. It will show the account number or the nickname, the name of the branch where your account is held, and when you click on the links you can view the available balance and last ten transactions of your account.

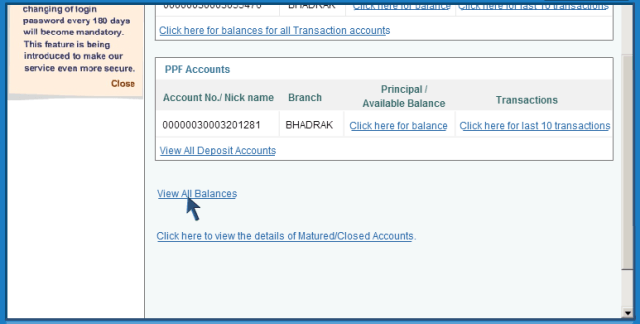

- The Account Summary page will also show two hyperlinks below the list of accounts. Click on View All Balances link.

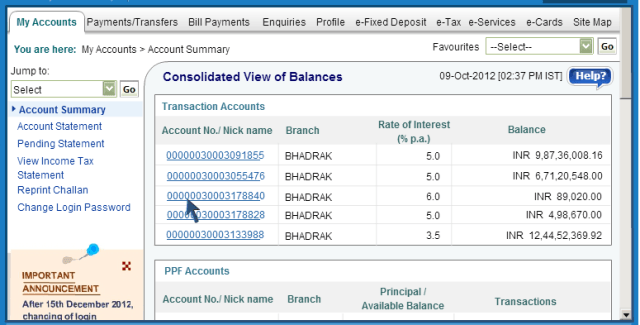

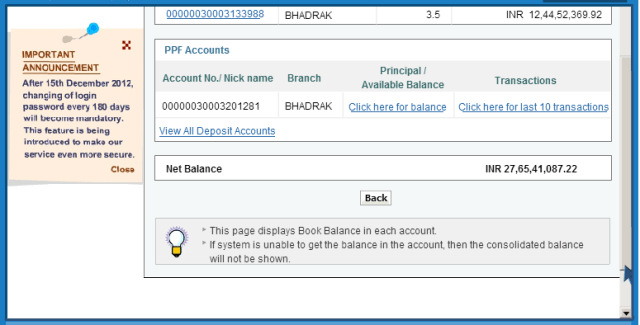

- You will see combine view of balances in all your accounts. Accounts are grouped by accounts type as transaction accounts, deposit accounts, etc.

- It also displays a consolidated view of deposit accounts with your account number, nickname, your branch name, the rate of interest and your balance. The loan account displays the amount outstanding on each loan account. Bottom of the Consolidated View of Balances page shows the Net Balance of all your accounts.

- The “Matured or Closed Account” – This hyperlink will tell you the details of matured deposits and closed accounts.

- If you have two or more transaction accounts then click on the “Click here for balances for all Transaction accounts” link. The link appears in the Account Summary under the last account number. You can view the sum of balances of all your transaction accounts.

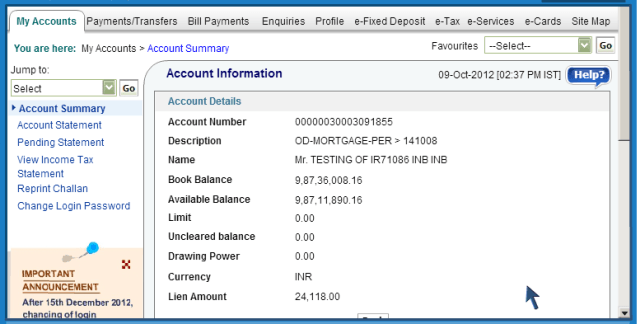

- To get further information about the account, click on the “Click here for the last 10 transaction” link against the account.

- If you have a savings account then on the Account Information Page you can see the account number, description of the type of account, your name, book balance, available balance, limit, uncleared balance, lien amount, drawing power and currency.

- The bottom half of the same page will show your last ten transactions of your account. Each entry will exhibit the transaction date (value date), narration, reference number, and debit or credit amount for the transaction.

A cheque book is a book that contains removable blank cheques and it is issued by a bank to the holders of Bank accounts. You can request for a cheque book via SBI Online Banking. You can ask for cheque books for any of your accounts (Savings Account, Current Account and OD Account). For a savings account, only multi city cheques will be issued via SBI Online Banking. If you want normal cheque book then contact your branch.

How to get Cheque Book through SBI Online Banking

- Login to your SBI online account.

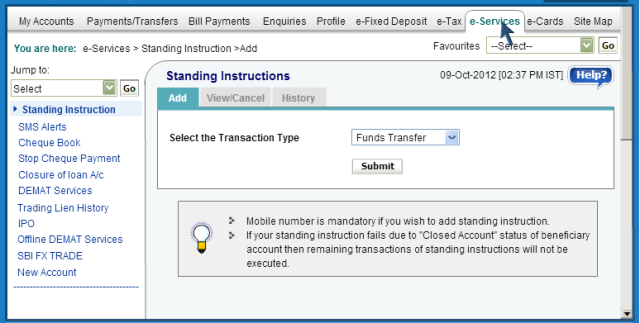

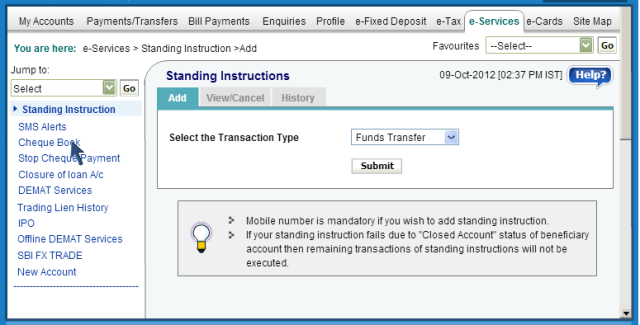

- Select the “e-Services” tab.

- Click on the “Cheque Book” option which is there on the left side of the page.

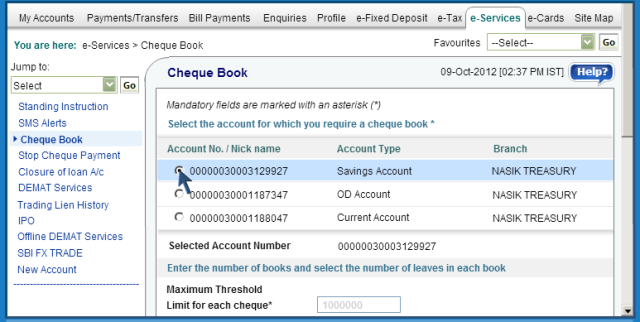

- Choose the account for which you want a cheque book.

- If you choose a savings account, then only multi city cheque book will be issued via Internet Banking. If you want a normal cheque book then please contact your branch.

- The maximum margin value for savings account multi city cheques (Rs 10 lakhs) is auto populated. You can issue cheques up to the margin value.

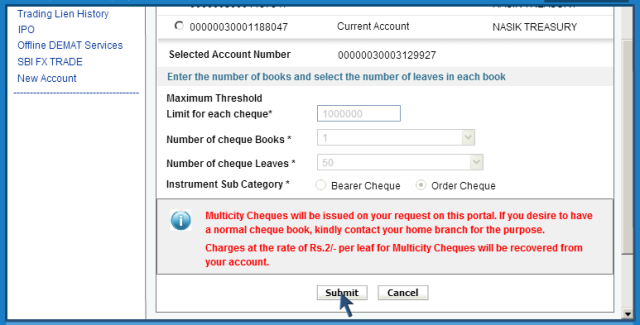

- The number of cheque books and a number of leaves in the cheque book are auto populated in the page as 1 and 50.

- The Instrument Sub Category is Order Cheque for saving accounts multi city cheques.

- Enter all the mandatory elements.

- Click “Submit”.

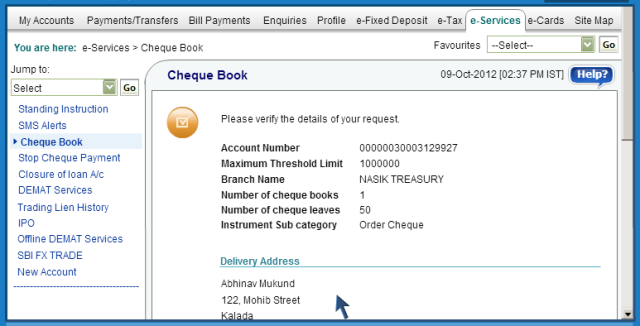

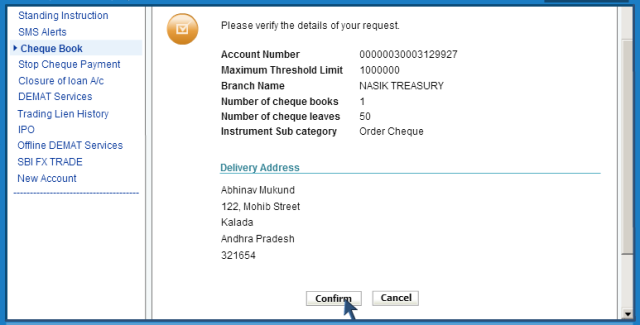

- Now you can see a page with the account number, branch name, cheque book category, number of cheque books, and a number of cheque leaves in a book and the instrument subcategory.

- You can even see your last available address in the page. The address shown in the page is as per the branch records. Your cheque book will be dispatched to this address.

- If the last available address is incorrect or if you have changed your residential address then click on the New Address option.

- Verify the transmit address and click “Submit”.

- You will be shown a page with your request details and your transmit address.

- Verify your details and click the “Confirm” option.

- You can see a confirmation page exhibiting a reference number, and timeline within which the cheque book will be issued.

Plz new account login